Making Tax Digital (MTD) for Income Tax

It has been confirmed that Making Tax Digital (MTD) for income tax will be phased in for self-employed individuals and landlords from April 2026.

What is MTD for Income Tax?

MTD is a mandatory requirement being introduced for eligible individuals (self-employed and landlords) to keep digital records and report their income and expenses to HMRC quarterly, instead of filing just a single Self-Assessment tax return each year.

From April 2026, if your gross turnover, rents or a combination of the two are greater than £50,000 then your income and expenses will need to be reported digitally to HMRC every quarter with an annual reconciliation also being completed (which we expect to be similar to the annual tax return).

From April 2027, the threshold will drop to £30,000 and it was confirmed in yesterday's Spring Statement that MTD for income tax will be made mandatory for the self-employed and landlords with gross income of more than £20,000 from April 2028.

Digital records

MTD for income tax will require self-employed businesses and landlords with qualifying income to keep digital records and file quarterly updates through an HMRC compatible software. HMRC have said that they will not be producing their own software and so individuals who will be affected by the new legislation need to choose a suitable commercial software package or use tailored spreadsheets and bridging software.

If you are not already using a software to maintain digital records or have any questions and would like some help, please get in touch with the office to discuss your particular circumstances, solutions, pricing and the support available well in advance. We have already partnered with providers such as Xero and Quickbooks (QBO) and have bridging software solutions to help manage the ongoing MTD transition, which started with VAT submissions several years ago.

What happens next?

From April 2025, HMRC will be writing to individuals whose 2023 / 2024 Self-Assessment tax returns reported gross income from self-employment and rental sources that was close to (or over) £50,000. Receipt of this letter will indicate that you are expected to comply with the new Making Tax Digital for Income Tax rules in the near future - Don’t panic but please speak with us asap if you receive an HMRC letter regarding MTD or expect your circumstances to meet the criteria described above, whether you receive a letter of not over the coming months!

AUTUMN BUDGET 2024

As the dust starts to settle following the Chancellor's Autumn Statement last week we have outlined some of the key announcements that may be of relevance to you, your business and those close to you, including significant changes to Employer National Insurance costs, Capital Gains Tax and Inheritance Tax.

Income Tax

No changes were announced to current income tax rates or thresholds, but current thresholds are remaining frozen until April 2028 as previously announced. From April 2028, thresholds will ‘unfreeze’ and increase in line with inflation.

National Insurance Contributions

Employers’ national insurance (including class 1A on some benefits in kind) will increase by 1.2% to 15% from 6 April 2025.

The Class 1 NIC secondary threshold (at which the 15% charge starts) will reduce from £9,100 to £5,000 per annum increasing the Er's NI liability per employee by £615 p.a. This will take effect from 6 April 2025 until 5 April 2028 and will then increase in line with CPI.

The employment allowance will increase to £10,500 (up from £5,000) from April 2025 and the £100,000 (previous tax year NICs liability) eligibility restriction will be removed making the allowance widely available.

National living and minimum wages

The National Living Wage for employees aged 21 and over will increase to £12.21 per hour from April 2025 (currently £11.44 per hour) making a full-time employee's salary £23,809.50 (based on 37.5 hours p.w on NLW). The National Minimum Wage for 18-20 year olds will rise to £10.00 per hour.

Capital Gains Tax

CGT rates – the main rates of CGT have been increased immediately to 18% and 24% (up from 10% and 20%) for disposals on or after 30 October 2024. The residential property rates remain unchanged at 18% and 24%.

For both business asset disposal relief (BADR – formerly Entrepreneurs Relief) and investors’ relief (IR), the 10% rate remains for the rest of this tax year but will increase to 14% from 6 April 2025 and then to 18% from 6 April 2026.

For assets qualifying for BADR, the lifetime limit of £1,000,000 of gains has not changed. BADR applies to the disposal of certain business assets, including the sale of a business or the sale of a qualifying shareholding (5% or qualifying enterprise management incentive shares) in a trading company/holding company of a trading group, in which you are an officer or employee.

However, for assets qualifying for IR, the lifetime limit of £10,000,000 has been reduced to £1,000,000 from 30 October. This applies to qualifying investor gains on newly issued ordinary shares of an unlisted trading company bought by individuals from 17 March 2016 and held for at least three years starting from 6 April 2016.

Non-domiciled individuals

The remittance basis of taxation for non-UK domiciled individuals will be abolished, with the concept of domicile being replaced with a residence based regime from 6 April 2025.

IHT

Inheritance tax threshold

The inheritance tax threshold provides a tax-free (NRB) allowance of £325,000 - the Chancellor extended the freeze of the threshold from April 2028 to April 2030. Together with the residential nil rate band of up to £175,000 this provides a total tax-free allowance up to £500,000, which combines to £1m for spouses and civil partners, providing the family home passes to direct descendants.

IHT - business relief and agricultural relief reforms

From 6 April 2026, the first £1 million of combined agricultural and business property (including qualifying shares held in family or personal companies) will continue to receive 100% relief, with 50% relief on amounts over £1 million.

Relief for other shares that are not listed on a recognised stock exchange, which includes AIM shares, will reduce to 50%. The £1m allowance does not apply to these shares.

Assets that receive 50% relief are subject to an effective IHT rate of 20%, as opposed to the main rate of 40%, where no relief is available.

The £1m will effectively be a ‘lifetime allowance’, covering the estate on death, failed gifts in the 7 years before death and lifetime transfers into trust. Any unused allowance will not be transferable between spouses.

Trusts will receive a combined £1million allowance. However, where a settlor has settled multiple trusts before 30 October 2024, each of those trusts will have its own £1million allowance.

IHT – unused pension funds and death benefits

From 6 April 2027, the government will bring in unused pension funds (including death benefits payable from a pension) into a person's estate for IHT purposes.

Business Taxes

Corporate Tax Roadmap – alongside the Budget, the government has published a Corporate Tax Roadmap with an emphasis on providing certainty for business, covering commitments to cap the main rate of CT at 25% and retain the current small profits rate (19% on profits up to £50K) and marginal relief structure, maintain full expensing, the £1m annual investment allowance and the ‘generosity of R&D reliefs’.

Capital allowances – 100% first-year allowances for zero-emission cars and electric vehicle charge points will be extended until April 2026.

Double Cab Pick Ups

From 1 April 2025 for Corporation Tax and 6 April 2025 for income tax, double cab pickups (with a payload of one tonne or more) will be classified as cars for capital allowances and benefit in kind purposes.

If you have purchased, leased or ordered a DCPU for an employee before 6 April 2025 you will still be able to use the previous treatment until the earlier of disposal, lease expiry or 5 April 2029, under some transitional rules.

Stamp Duty Land Tax

The existing higher rates of Stamp Duty on the purchase of an additional residential property in England or Northern Ireland by an individual will increase from 3% to 5% for transactions with an effective date (normally completion) on or after 31 October 2024. This will also apply to the purchase of a residential property by a company that is not liable to the single rate of SDLT.

The single rate of SDLT that applies to the purchase of a residential property for more than £500,000 by a company in England or Northern Ireland and which is not intended to be used for certain commercial purposes will increase from 15% to 17%.

If contracts were exchanged before 31 October 2024 but are completed on or after that date, transitional rules may apply.

Late Payment Charges

Late payment interest is currently set at base rate plus 2.5%

From 6 April 2025, the interest rate on unpaid tax liabilities charged by HMRC will increase by 1.5 percentage points to 4% above the base rate.

Company Car Tax

It has already been announced that from April 2025 all company car percentages will be increased by 1% each.

It was announced in the budget that from April 2028 the increase will be 2% per year meaning that the benefit in kind for a zero emissions car will be 9% of the list price by 2029/2030 tax year.

The percentages for all cars with emissions of 1 to 50g of CO2 per kilometre, including hybrid vehicles, will rise to 18% in tax year 2028/29 and 19% in tax year 2029/30

This contrasts with the percentages for all other vehicle bands, which will increase by 1% per year in tax years 2028/29 and 2029/30, to a maximum of 38% for 2028/29 and 39% for 2029/30. This will mean that the cost of the benefit of an EV remains substantially lower for the company car driver, but significantly greater than the recent regime.

VAT on private school fees

It was confirmed that the VAT exemption will be removed from 1 January 2025 on private school fees.

Support and guidance:

We hope that the above summary provides you with a view of some of the latest developments and key areas from the budget that may affect you and your families now and into the future – as always, it is not intended to be a comprehensive list of all of the changes, or a substitute for comprehensive tailored advice and so if you have any queries or concerns, please call the office to arrange a meeting to discuss your specific circumstances and plans.

Barnett & Turner Accountants Ltd

Chartered Accountants

Cromwell House

68 West Gate

Mansfield

NG18 1RR

Nottinghamshire

Tel: 01623 659659

Fax: 01623 420844

Spring Budget 2023

Following the chancellor’s spring budget on 15 March 2023 we have outlined some of the key announcements that may be of relevance to you and those dearest to you.

Capital Allowances

The super deduction allowance officially ends on 31 March 2023. Where super-deduction expenditure is incurred in a chargeable period ending on or after 1 April 2023, the 130% super-deduction decreases. The 30% uplift is reduced to reflect the number of days in the chargeable period either side of 1 April 2023.

The government have announced that the super-deduction will be replaced with a new temporary first year allowance (FYA) for companies only.

FYAs will apply to qualifying expenditure on new and unused plant and machinery incurred on or after 1 April 2023 and before 1 April 2026 that would have normally qualified for the main rate of 18%.

For main rate expenditure, the FYA is 100% so that the expenditure is ‘fully expensed’ in the year of purchase.

For special rate expenditure the FYA is 50%.

Like the super deduction there is no limit to the amount of qualifying expenditure a company can claim for.

Annual Investment Allowance (AIA)

For items not covered by the above allowances it was also announced that the AIA limit of £1m will be made permanent. Unlike the above, AIA can be claimed by sole traders and partnerships (providing partners are all individuals), as well as companies.

Electric Charging Points

The 100% FYA for expenditure on electric vehicle charging points was due to end in 2023. This has now been extended so that the allowance will be available for expenditure by companies until 31 March 2025 and by sole traders and partnerships until 5 April 2025.

Pensions - Annual Allowance Increases

Where pension contributions for a year exceed the Annual Allowance, the excess is subject to charge at the person’s marginal rate of income tax. The available Annual Allowance is also tapered by £1 for every £2 that adjusted income exceeds a defined limit.

From 6 April 2023, the Annual Allowance will increase from £40,000 to £60,000. The adjusted income limit will increase from £240,000 to £260,000 and, where tapering applies, the minimum tapered Annual Allowance will be £10,000, up from £4,000.

Pensions - Lifetime Allowance changes

On a ‘benefit crystallising event’ (e.g. first accessing a pension or 75th birthday), pension funds are tested and, if their value exceeds the Lifetime Allowance (currently £1.07m), the excess is subject to a tax charge. When the excess is taken from the pension as a lump sum, tax is charged at a rate of 55%. Where the excess remains in the pension fund it will be taxed at 25% (recognising that it will subsequently be subject to tax via PAYE on draw down).

From 6 April 2023 the Lifetime Allowance will be abolished.

The Lifetime Allowance limit will, however, continue to exist for the purpose of capping the 25% tax-free lump sum available when first accessing a pension. This means that, in most circumstances, the maximum tax-free lump sum a taxpayer could accrue will be £268,275. However, where a pension protection is held, the maximum lump sum is 25% of the protected amount.

Capital Gains Tax: Separation and Divorce

Currently, ‘no gain, no loss’ treatment is only applied up to the end of the tax year in which spouses or civil partners separate.

From 6 April 2023 the rules will be as follows:

separating spouses or civil partners will be given up to three years after the year they cease to live together in which to make no gain, no loss transfers.

no gain, no loss treatment will also apply without a time limit to assets that separating spouses or civil partners transfer between themselves as part of a formal divorce agreement.

a spouse or civil partner who retains an interest in the former matrimonial home will be given the option to claim Private Residence Relief (PRR) when it is sold.

individuals who have transferred their interest in the former matrimonial home to their ex-spouse or civil partner (and are entitled to receive a percentage of the proceeds when that home is eventually sold) will be able to apply the same tax treatment to the proceeds ultimately received, that applied when they transferred their original interest in the home to their ex-spouse or civil partner.

Corporation Tax

From 1 April 2023, there is no longer a single corporation tax rate for profits.

A small profits rate of 19% will apply for for companies with profits of £50,000 or less.

Companies with profits exceeding £250,000 will pay the main rate of corporation tax, being 25%.

Companies with profits between £50,000 and £250,000 will pay tax at the main rate of 25%, reduced by a marginal relief deduction. This results in a gradual increase in the effective corporation tax rate from the small profits rate of 19%. The effect of this is that profits between £50,000 and £250,000 will actually be taxed at 26.5%.

The £50,000 and £250,000 limits will be divided by the number of associated companies. For accounting periods shorter than 12 months, these limits are also proportionately reduced. These factors can mean that even if profits in one company are under £50,000, the main rate (25%) or a marginal rate between 19% and 25% might apply, due to the existence of additional associated companies.

Broadly speaking, two companies are associated if one has control over the other, or both are under the control of the same person or persons. There are rules that ensure that such attribution only occurs where there is substantial financial, economic or organisational interdependence between the companies concerned – for example they trade from the same premises or rely on each other financially.

If you believe you will be affected by the above, or think that there may be more than one company under your control or even other companies under the control of your tax associates that we haven’t already discussed recently, please speak with us.

Changes to VAT penalties

A brief summary of the new system is outlined below. New late payment penalty rules and a points-based late submission penalty regime were introduced from 1 January 2023, replacing the VAT default surcharge. These apply to accounting periods for returns and payments due by 7 March 2023.

Late submission penalties - These work on a points-based system. For each VAT return submitted late, businesses will receive a penalty point until they reach the penalty point threshold – at which stage they will receive a £200 penalty. A further £200 penalty will also apply for each subsequent late submission while at the threshold, which varies to take account of monthly, quarterly and annual accounting periods. In a similar way to points on your driving license, late submission points will only be cleared after a period of consecutive compliance.

Late payment penalties - If a VAT payment is more than 15 days overdue, businesses will pay a first late payment penalty at 2%. If the VAT payment is more than 30 days overdue, the first late payment penalty increases by another 2% and a second late payment penalty of an additional 2% will also apply to the amount still outstanding (i.e. 4% at 30 days if nothing has been paid). To help get used to the changes, HMRC have said that they will not charge a first late payment penalty on VAT payments due on or before 31 December 2023, if businesses either pay in full or a time to pay arrangement is agreed within 30 days of the payment due date.

Payment plans - HMRC may support businesses that cannot pay their VAT bill in full. Businesses can request to set up a payment plan with HMRC to pay their tax bills in instalments. After 31 December 2023, if a customer proposes a payment plan within 15 days of payment being due and HMRC agrees it, they would not be charged a late payment penalty, provided that they keep to the conditions of the payment plan. Late payment penalties can apply where proposals are made after the first 15 days, but the agreement of the payment plan can prevent them increasing.

Interest calculations - HMRC has introduced both late payment and repayment interest, which will replace previous VAT interest rules. This brings the new regime in line with other taxes. Overdue taxes will attract interest charges at 2.5% above base rate.

Research and development (R&D) tax relief

Enhanced corporation tax relief may be available if a company carries out certain qualifying R&D activities related to its trade. HMRC’s rules are relatively complex and are evolving but we have expert R&D colleagues who can help ensure that qualifying projects are correctly identified and you obtain the maximum benefit available from this relief wherever possible.

To qualify for the enhanced relief, a company must have incurred research and development costs on projects that involve uncertainty where solutions aren’t already common knowledge, hence aiming to advance science or technology. If you think you may have undertaken any R&D activity during the year, please speak with us.

Support and guidance:

We hope that the above summary provides you with a view of some of the latest developments and key areas from the budget that may affect you and your families now and into the future – as always, it is not intended to be a comprehensive list of all of the changes, or a substitute for comprehensive tailored advice and so if you have any queries or concerns, please call the office to arrange a meeting to discuss your specific circumstances and plans.

Barnett & Turner Accountants Ltd

Chartered Accountants

Cromwell House

68 West Gate

Mansfield

NG18 1RR

Nottinghamshire

Tel: 01623 659659

Fax: 01623 420844

Digital Tax Compliance Continues to Evolve

With most compulsory VAT registered businesses reporting under Making Tax Digital (MTD) for a few years now, HMRC are looking towards the next tranche of MTD compliance.

The following update may already be in hand or may not affect you directly but feel free to forward on to anyone that you think may benefit from the summary:-

Making Tax Digital for VAT – what’s next?

The Government is extending the requirement to operate (MTD) beyond compulsory VAT registered businesses to include voluntarily VAT registered businesses. For VAT periods starting on or after 1stApril 2022 voluntary VAT registered businesses will also be required to keep digital records and submit VAT returns through a compatible software. Manual returns will no longer be submitted through HMRC’s website. Affected businesses may have already received a letter from HMRC about these changes.

If you or anyone you know would like to discuss this with one of the team including the tailored solutions available, please feel free to call the office and speak to the team.

Making Tax Digital for Income Tax

From 6th April 2024, MTD will also apply to the self employed and landlords with aggregate turnover and / or gross rental income of greater than £10,000.

Affected taxpayers will be required to submit to HMRC quarterly returns on qualifying income and expenses via their personal digital tax account. For now this does not affect taxpayers who are taxed entirely via PAYE or trade only via a limited company. MTD for corporation tax is expected to be announced after MTD for income tax has been successfully rolled out.

Please note that if you have turnover from your self employment of lower than £10,000 and gross rental income of less than £10,000 but in aggregate they are over £10k, both will need to be reported quarterly under MTD as the gross aggregate is key.

We are currently awaiting further information from HMRC regarding the specific rules on MTD for income tax but in the meantime are already working with various software solutions to help meet your needs.

We will keep you posted with further updates as we receive them but please speak with us if you have any queries in the meantime.

Autumn Budget Update 2021

AUTUMN BUDGET UPDATE 2021

Now that the dust has settled and we have been able to review more of the details, here are some of the headline points to forward from the budget at the end of October...

Income Tax Rates and allowances for 2022/23

From 6 April 2022 to 5 April 2026 the personal allowance will increase to £12,570 and the higher rate threshold at £50,270.

National insurance Class 4 limits

The National Insurance rates will rise by 1.25% from 6 April 2022, however from April 2023 the rates will revert to their previous levels and a new 1.25% Health and Social Care Levy will apply to employers, employees and the self employed (including those above State pension age).

The table below shows the changes for the next 2 years:

Capital Gains Tax

The capital gains tax annual exempt amount will remain at £12,300 for the tax year ended 5 April 2023.

Capital Gains Tax payment window

From 27 October 2021 the deadline for UK residents to report and pay CGT after selling a UK residential property will increase from 30 days to 60 days.

For non UK residents disposing of property in the UK the deadline will also increase from 30 days to 60 days.

Inheritance Tax

Inheritance tax thresholds and rates are unchanged. The nil rate band will remain at £325,000 for the 2022/2023 tax year.

The residence nil rate band will also remain at £175,000

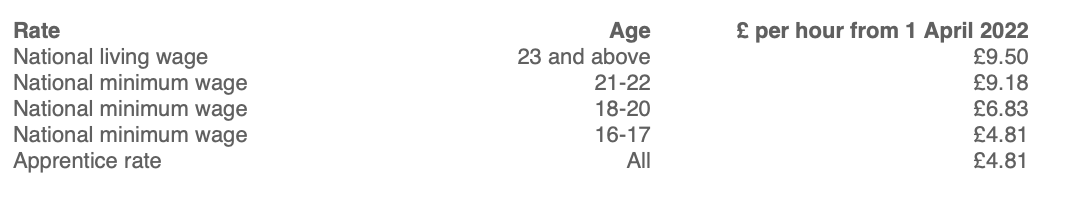

National Living Wage

The rates for National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school leaving age) from 1 April 2022 are shown below.

Dividend Tax

The dividend allowance will remain at £2,000. The rate of tax on divdends will rise by 1.25% from April 2022 as shown in the table below.

Corporation Tax

The main rate of corporation tax will remain at 19% for the year commencing 1 April 2022 and will rise to 25% from April 2023 for business with profits of £250,000 and over.

The rate for businesses with profits of £50,000 or less will remain at 19% however there will be a marginal rate (at 26.5%) for profits between £50,000 and £250,000.

Super-deduction for investments in plant and machinery

A reminder that companies liable to corporation tax will temporarily be entited to increase allowances for expenditure on new plant and machinery.

For qualifying expenditure incurred from 1 April 2021 up to and including 31 March 2023 companies will be able to claim a super deduction providing a first year allowance of 130% on most new plant and machinery additions that ordinarily qualify for 18% main rate writing down allowances.

Also a first year allowance of 50% is available on most new plant and machinery investments that ordinarily qualify for 6% special rate writing down allowances.

The relief will not apply to contracts entered into prior to Budget day on 3 March 2021.

Annual Investment Allowance (AIA)

The temporary £1 million level of AIA has been extended to 31 March 2023.

Recovery Loan Scheme

The recovery loan scheme will be extended to 30 June 2022 for small and medium sized business but the government guarantee will be reduced from 80% to 70%.

VAT

Registration and deregistration thresholds

The current VAT thresholds for registration and deregistration (£85,000 and £83,000 respectively) will be maintained until 31 March 2024.

Company Car and Van benefits

The company car fuel multiplier will increase to £25,300 from April 2022.

The company van benefit will increase to £3,600 from April 2022.

The van fuel benefit will increase to £688 from April 2022.

The company car benefit for electric cars will increase to 2% of the list price from 6 April 2022 (currently 1%).

The table below shows the rates for all company cars from 6 April 2022:

Flexible furlough and a second self-employment income support grant (SEISS) - 8th June 2020

A little over a week ago, The Chancellor announced details of how flexible furloughing will work, along with some changes to the scheme moving forward and the key dates. This included brining the option for part-time furloughing forward to 1st July to facilitate a smoother transition back to work as the UK attempts to navigate its way out of the COVID-19 lockdown.

At the same time, a second self-employment income support scheme grant (SEISS) was also announced, this time at 70% of average monthly trading profits compared to the first claim at 80% but otherwise calculated and payable on the same basis as the first.

We’ve provided a summary of some of the key features below for each scheme however here is a link to HMRC’s latest guidance, including a flexible furlough timeline:

Flexible Furlough:

It has already been confirmed that the furlough scheme, originally introduced in March this year, will be available in some way for those that qualify until the end of October 2020. However, we now have some detail on the timeline and tapered rates that will apply, including the impact and changing cost to the employer as the scheme is unwound. As the flexibility comes in and rates change, it is anticipated that many unique and specific circumstances will exist for employers, impacting claims and calculations, making it more important than ever to prepare and keep accurate and precise records of staff movements.

It is also important to note that only those that have already been furloughed will be allowed into the flexible scheme going forward - for those that have been furloughed once (or more) already, there appears to be no issue, but it does mean that anyone being furloughed for the first time will need to have been furloughed by 10th June to serve their 3 weeks minimum furlough period by the end of June 2020 so that they in turn can qualify for the flexible / part-time scheme from 1st July onwards if required.

All furlough claims for periods up to 30th June will need to be made by 31st July and claims for periods commencing 1st July can not be made for more employees than the maximum number claimed for in a previous period.

Second SEISS:

A second grant for the self-employed will be based upon the same eligibility criteria as the first, although calculated at 70% rather than 80% of average profits, subject to a cap of £6,570 second time around.

It is important to note that you do not have to have claimed the first grant (which remains available until 13 July) to claim the second, which will be available in August 2020. It has also been announced that this will be the final SEISS grant to be made available.

More information on both schemes is expected on Friday 12th June.

Take care and stay safe,

Jono, David and all of us at B&T

Bounce-back loans and updates on the self-employment income support scheme

This week has seen the opening of the bounce-back loan support scheme with 100% government guarantees (maximum available £50k) designed to release money to small and medium businesses quicker and with less hassle than under a full CBILS application.

There have also been updates on the self-employment income support scheme which will open on 13th May 2020 for applications.

Here’s our brief video on the above 2 measures, including some of the information you’ll require on hand.

Here is the latest guidance from HMRC which includes their online checker tool to confirm eligibility for the self-employment income support scheme - https://www.gov.uk/guidance/claim-a-grant-through-the-coronavirus-covid-19-self-employment-income-support-scheme - agents are not able to make claims on your behalf but can help by using the eligibility tool with you.

And also to the bounce-back loan scheme - https://www.gov.uk/guidance/apply-for-a-coronavirus-bounce-back-loan

You can apply for a bounce back loan via your existing bank (see their website) an alternative approved funder or through the link above but please be aware of fraud when uploading sensitive or confidential data online.

Take care and stay safe

Jono, David and all of the team at B&T

Furlough Portal Opens for claims and some practical points to consider - 20 April 20

This week sees the new furlough claims portal at HMRC open for the first time. HMRC have said that approved claims will be transferred to client bank accounts within 6 days of claims and the scheme has now been extended to the end of June 20. Records supporting claims must be retained for 5 years to enable retrospective audits by HMRC.

Here’s our latest video covering some practical points around the claims process and managing ongoing changes in our day to day working lives:

Please be aware of the increased risk of fraud when uploading sensitive information via new online links, attachments and portals.

Here is HMRC’s latest furlough claims guidance, including an example of a basic claim calculation:

Here is also a link to some guidance on working from home and claiming for costs:

Please note that the landscape continues to change but we will be here to help you wherever we can as more detail becomes available. Your patience is appreciated whilst we navigate the new processes to access support that may be available to you.

Take care and stay safe

Jono, David and all of us at B&T

Latest on business & individual financial support available

It has now been a few days since many of the financial support measures were first announced, although relatively few official updates have been given since. The rules are therefore yet to be set in stone however we are steadily getting more clarity and here is our video update on some of the key points that may affect you.

Please be aware of the increased risk of fraud when uploading sensitive information via new online links, attachments and portals.

HMRC LATEST GUIDANCE:

Please note that the landscape continues to change. We are awaiting detailed information on the steps that need to be taken to access your most appropriate support options but please be assured that we will be here to help you wherever we can as more information is made available in the coming days.

You can also sign up for updates as things change on the HMRC website given that updates are taking place all the time - https://www.gov.uk/email-signup?link=/government/topical-events/coronavirus-covid-19-uk-government-response

Take care & stay safe,

Jono, David and all of us at B&T

Latest information on the new Job Retention Scheme (Furloughing) as of 29/03/2020

Every day more information is released about the new Coronavirus Job Retention Scheme but there remain a number of questions that are yet to be answered. Here is our video summary of the key points that have been announced so far along with highlighting some of the questions that remain at the current time:

This measure appears to be a very strong response from the UK Government to protect our economy in the fight against the Coronavirus but as with any new system, it remains to be seen where the gaps are and what the outcome will be, particularly in some of the more unique circumstances. The online portal to make claims is not expected to be available until the end of April 2020 and HMRC have reserved the right to audit claims made retrospectively.

HMRC's latest link to the Job Retention Scheme does clear up some previously unanswered queries, (eg. the minimum period of furlough being 3 weeks) - view the following link to see whether your circumstances are covered: https://www.gov.uk/guidance/claim-for-wage-costs-through-the-coronavirus-job-retention-scheme

Please be aware of the increased risk of fraud when uploading sensitive information via new online links, attachments and portals.

You can also sign up for updates as things change on the HMRC website given that updates are taking place all the time - https://www.gov.uk/email-signup?link=/government/topical-events/coronavirus-covid-19-uk-government-response

Take care and stay safe,

Jono, David and all the team at B&T