Making Tax Digital (MTD) for Income Tax

It has been confirmed that Making Tax Digital (MTD) for income tax will be phased in for self-employed individuals and landlords from April 2026.

What is MTD for Income Tax?

MTD is a mandatory requirement being introduced for eligible individuals (self-employed and landlords) to keep digital records and report their income and expenses to HMRC quarterly, instead of filing just a single Self-Assessment tax return each year.

From April 2026, if your gross turnover, rents or a combination of the two are greater than £50,000 then your income and expenses will need to be reported digitally to HMRC every quarter with an annual reconciliation also being completed (which we expect to be similar to the annual tax return).

From April 2027, the threshold will drop to £30,000 and it was confirmed in yesterday's Spring Statement that MTD for income tax will be made mandatory for the self-employed and landlords with gross income of more than £20,000 from April 2028.

Digital records

MTD for income tax will require self-employed businesses and landlords with qualifying income to keep digital records and file quarterly updates through an HMRC compatible software. HMRC have said that they will not be producing their own software and so individuals who will be affected by the new legislation need to choose a suitable commercial software package or use tailored spreadsheets and bridging software.

If you are not already using a software to maintain digital records or have any questions and would like some help, please get in touch with the office to discuss your particular circumstances, solutions, pricing and the support available well in advance. We have already partnered with providers such as Xero and Quickbooks (QBO) and have bridging software solutions to help manage the ongoing MTD transition, which started with VAT submissions several years ago.

What happens next?

From April 2025, HMRC will be writing to individuals whose 2023 / 2024 Self-Assessment tax returns reported gross income from self-employment and rental sources that was close to (or over) £50,000. Receipt of this letter will indicate that you are expected to comply with the new Making Tax Digital for Income Tax rules in the near future - Don’t panic but please speak with us asap if you receive an HMRC letter regarding MTD or expect your circumstances to meet the criteria described above, whether you receive a letter of not over the coming months!

Digital Tax Compliance Continues to Evolve

With most compulsory VAT registered businesses reporting under Making Tax Digital (MTD) for a few years now, HMRC are looking towards the next tranche of MTD compliance.

The following update may already be in hand or may not affect you directly but feel free to forward on to anyone that you think may benefit from the summary:-

Making Tax Digital for VAT – what’s next?

The Government is extending the requirement to operate (MTD) beyond compulsory VAT registered businesses to include voluntarily VAT registered businesses. For VAT periods starting on or after 1stApril 2022 voluntary VAT registered businesses will also be required to keep digital records and submit VAT returns through a compatible software. Manual returns will no longer be submitted through HMRC’s website. Affected businesses may have already received a letter from HMRC about these changes.

If you or anyone you know would like to discuss this with one of the team including the tailored solutions available, please feel free to call the office and speak to the team.

Making Tax Digital for Income Tax

From 6th April 2024, MTD will also apply to the self employed and landlords with aggregate turnover and / or gross rental income of greater than £10,000.

Affected taxpayers will be required to submit to HMRC quarterly returns on qualifying income and expenses via their personal digital tax account. For now this does not affect taxpayers who are taxed entirely via PAYE or trade only via a limited company. MTD for corporation tax is expected to be announced after MTD for income tax has been successfully rolled out.

Please note that if you have turnover from your self employment of lower than £10,000 and gross rental income of less than £10,000 but in aggregate they are over £10k, both will need to be reported quarterly under MTD as the gross aggregate is key.

We are currently awaiting further information from HMRC regarding the specific rules on MTD for income tax but in the meantime are already working with various software solutions to help meet your needs.

We will keep you posted with further updates as we receive them but please speak with us if you have any queries in the meantime.

Autumn Budget Update 2021

AUTUMN BUDGET UPDATE 2021

Now that the dust has settled and we have been able to review more of the details, here are some of the headline points to forward from the budget at the end of October...

Income Tax Rates and allowances for 2022/23

From 6 April 2022 to 5 April 2026 the personal allowance will increase to £12,570 and the higher rate threshold at £50,270.

National insurance Class 4 limits

The National Insurance rates will rise by 1.25% from 6 April 2022, however from April 2023 the rates will revert to their previous levels and a new 1.25% Health and Social Care Levy will apply to employers, employees and the self employed (including those above State pension age).

The table below shows the changes for the next 2 years:

Capital Gains Tax

The capital gains tax annual exempt amount will remain at £12,300 for the tax year ended 5 April 2023.

Capital Gains Tax payment window

From 27 October 2021 the deadline for UK residents to report and pay CGT after selling a UK residential property will increase from 30 days to 60 days.

For non UK residents disposing of property in the UK the deadline will also increase from 30 days to 60 days.

Inheritance Tax

Inheritance tax thresholds and rates are unchanged. The nil rate band will remain at £325,000 for the 2022/2023 tax year.

The residence nil rate band will also remain at £175,000

National Living Wage

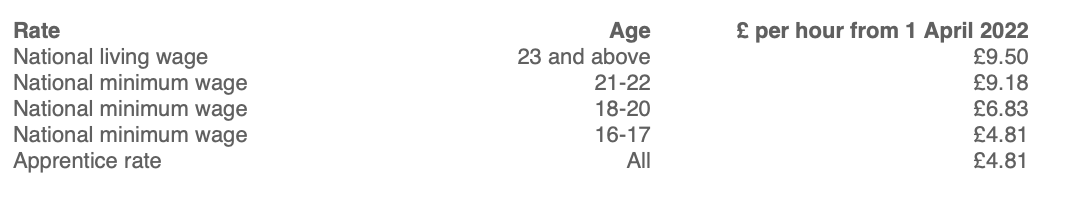

The rates for National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school leaving age) from 1 April 2022 are shown below.

Dividend Tax

The dividend allowance will remain at £2,000. The rate of tax on divdends will rise by 1.25% from April 2022 as shown in the table below.

Corporation Tax

The main rate of corporation tax will remain at 19% for the year commencing 1 April 2022 and will rise to 25% from April 2023 for business with profits of £250,000 and over.

The rate for businesses with profits of £50,000 or less will remain at 19% however there will be a marginal rate (at 26.5%) for profits between £50,000 and £250,000.

Super-deduction for investments in plant and machinery

A reminder that companies liable to corporation tax will temporarily be entited to increase allowances for expenditure on new plant and machinery.

For qualifying expenditure incurred from 1 April 2021 up to and including 31 March 2023 companies will be able to claim a super deduction providing a first year allowance of 130% on most new plant and machinery additions that ordinarily qualify for 18% main rate writing down allowances.

Also a first year allowance of 50% is available on most new plant and machinery investments that ordinarily qualify for 6% special rate writing down allowances.

The relief will not apply to contracts entered into prior to Budget day on 3 March 2021.

Annual Investment Allowance (AIA)

The temporary £1 million level of AIA has been extended to 31 March 2023.

Recovery Loan Scheme

The recovery loan scheme will be extended to 30 June 2022 for small and medium sized business but the government guarantee will be reduced from 80% to 70%.

VAT

Registration and deregistration thresholds

The current VAT thresholds for registration and deregistration (£85,000 and £83,000 respectively) will be maintained until 31 March 2024.

Company Car and Van benefits

The company car fuel multiplier will increase to £25,300 from April 2022.

The company van benefit will increase to £3,600 from April 2022.

The van fuel benefit will increase to £688 from April 2022.

The company car benefit for electric cars will increase to 2% of the list price from 6 April 2022 (currently 1%).

The table below shows the rates for all company cars from 6 April 2022:

What are the implications of becoming an increasingly digital organisation?

A reality of the modern world is one of constant change. At a technical level this means the frequent release of new digital services to users, without them noticing and a move away from long release cycles and big-bang implementation (and the associated drama).

At an organisational level the differences are profound. Digitisation and automation shifts the demand for resource, away from operations and towards change delivery. This means that organisations need to commit their A-team, with all the right skills to design, develop and deploy the new services.

In an increasingly uncertain world, organisations need to adapt quickly. This requires strong leadership and support from all levels of an organisation. Like the digital technology, organisational change is best delivered in short iterations, allowing engagement, commitment and support to grow over time.

Once organisations have adopted a mind-set of constant change there are three areas to consider: digital platforms (over products and services); new capabilities; and new ways of working.

In addition to embracing digital and delivering services through digital channels, there is a wider opportunity to start benefiting from the (positive) disruption that results from digital platforms (similar to those that we all use on a daily basis like Google, Amazon, Uber, AirB&B and LinkedIn). These platforms share a number of characteristics.

They are digital businesses whose users identify with the channel (through which they receive the service) and not the organisation providing the service;

Ease of use means that the user experience is so intuitive that there is no training requirement, and as a result, being almost entirely self-service; and

Disintermediating by removing unnecessary duplication and waste – for example tasks, activities, people and sometimes entire organisations – from operations.

These characteristics can become guiding principles. They also infer a different business model and so, achieving them requires a transition from ‘organisation’ into ‘digital platform,’ a seismic shift that demands careful thinking about purpose, strategy, culture and structure.

Becoming increasingly digital requires new skills and capabilities and different ways of working. Many are common place (for example User Research, Service Design, Agile software and UX design). However, these capabilities need to extend beyond technology and as they evolve they bring new challenges with them:

Extending beyond scrum teams by making agile work at scale and introducing new frameworks and new capabilities;

Securing resource in a hot digital skills market that is currently unable to keep up with demand; and

Engaging strategic partners, who you are confident that you can work with, to supplement in-house digital skills without long and uncertain procurement processes.

These are good problems to have, because they indicate that an organisation is bridging the gap between the pre and post digital world. However, they emphasise the need for continuous improvement as ‘becoming digital’ throws up new and different challenges.

In addition to establishing and developing new capabilities, those embracing digital need to consider the implications for employee engagement, their ways of working and ultimately their culture. It is pointless establishing Agile teams who are empowered to deliver if policies, performance management and career development pathways all act counter to their day to day ways of working. This requires a focus on:

Engaging the workforce, the organisational culture needs to reflect the reality of the digital world, this is essential for recruitment and retention;

Taking new approaches to workforce development, this becomes increasingly important in bridging digital skills (and generational) gaps; and

Living the new behaviours, the tone for the new culture is set by the senior leaders, addressing capability (and credibility) gaps needs to start with the senior team.

It is essential that the chasm between ‘digital’ and ‘everything else’ gets smaller. The key to success is going further than building good digital products and services, by starting to become a digital organisation.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

The making of a memorable corporate event

Jono Wilson of Barnett & Turner in Nottinghamshire shares five great suggestions for organising the ideal corporate workshop or event.

I’ve been involved in presenting at a number of (internal and external) events but have learnt over time that you need to be methodical in your planning for everything to work. Here are a few of my top tips:

Make sure you have a clear objective

What is the purpose of your event? It clearly needs to be something of relevance to your target audience and have value for your company too.

You also need to know exactly what you’re aiming to get out of the workshop. Are you informing existing customers about changes in your market place or is it an opportunity to convert prospects? How much of a sales element about a specific product or service is appropriate?

Whoever your audience is, remember that it’s not often that all of the people you invite will ultimately attend, so you may have to reach out to a much wider group initially depending on the subject.

Get all the key staff involved from the start

Good communication is essential. You’ll almost certainly need to draw on the support of colleagues and people with particular expertise, so get them involved from the beginning. Brainstorm everything that will need doing and create an action plan with a clear sense of priorities, responsibilities and deadlines. Getting this kind of buy-in at an early stage will be important.

Focus on timing

You’ll need to decide the best time to hold the event. Breakfast meetings often work well, as people can stop off before work and it’s not too disruptive to their day. You might feel that something after office hours – perhaps accompanied by a glass of wine – is more appropriate.

Whatever you choose, the timing of the invitations is just as important. I recommend sending out your first emails four weeks before the event and then following up with a couple of weeks to go. If you contact people too early, they can easily put it to the back of their minds. But equally, it’s fatal to leave it too late. Make sure you have a clear deadline for RSVPs.

Keep things on track

Hold regular meetings in the run-up to the event, so that you can monitor progress and take action to boost attendance if necessary. It’s also a chance to plan for the practical arrangements on the day, as everything needs to run smoothly if you’re to give a good impression of your business.

Be prepared on the day

There will always be potential glitches – that microphone that doesn’t work or the last-minute catering hiccup. It’s no problem, provided you’re on the case and prepared. If you’ve followed all the ‘to-do’ instructions on your action plan, the chances are that you’ll have contingency plans in place for most things.

Remember that the event needs to be engaging, so discourage speakers from ‘Death by PowerPoint’ and make the session interactive, with the use of visuals and the opportunity for questions and answers. You may even want to introduce some kind of ice-breaker at the start. Make sure you ask for people’s feedback and – most important of all – follow up with a thank you for attending.

Good luck!

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

If your business is going under, make sure you don’t go the same way.

When a company is technically insolvent, it can be all-too-easy to end up on the wrong side of the law writes Jono Wilson of accountancy firm Barnett & Turner.

If you’re a company director and your business has run into financial difficulties, it’s important to take professional advice at the earliest possible stage. If you end up trading wrongfully or fraudulently, the chances are you will come to the attention of The Insolvency Service – the executive agency of the Department for Business, Energy and Industrial Strategy, which will tackle directors who have breached their duties and responsibilities under the Company Acts. Critically, it doesn’t matter whether that breach has been intentional or unintentional.

The Insolvency Service has the legal power to investigate when they receive reports of misconduct, fraud or scams. They will also act, however, over the conduct and actions of company directors when businesses have entered into administration or liquidation.

What should you watch out for?

An Insolvency Practitioner will submit a report to the Insolvency Service basedon the conduct of directors in the run-up to the company’s demise. If you’ve failed to keep proper books, for example, not paid taxes that are owed or continued to trade to the detriment of creditors, you may end up with restrictions imposed on you or a disqualification.

When disqualified (which can be for a period of up to 15 years), you will be listed on a Companies House database and cannot be a director of a UK company or a foreign company operating in the UK. You are also barred from getting involved in the formation, management or marketing of a company. People who contravene these restrictions can be fined or even imprisoned for up to two years.

What should you be doing?

Good practice means that you keep accurate books and records at all times and if you suspect your business may be insolvent (see the following website for guidance: https://www.gov.uk/government/publications/options-when-a-company-is-insolvent/options-when-a-company-is-insolvent) only trade or incur additional liabilities if you realistically believe the business can return to solvency once again. You’ll need to document your decisions and take legal advice, as well as consult an insolvency practitioner.

Don’t take deposits for orders you can’t fulfil and avoid incurring credit or issuing cheques that you can’t honour. Avoid preferring certain creditors, as it can’t be to the detriment of the main body of creditors, to whom you owe a duty.

It’s a complex area and other rules and restrictions apply, so the key thing is to start consulting your professional advisers as soon as you suspect your business may become insolvent at some point in future.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Agile approaches to a changing world

Agile working is much more than methodology, argues Jono Wilson of Barnett & Turner. It’s a whole different way of thinking about how work is done and managed, how teams deliver and how we behave.

We’re all conscious that the world is changing dramatically. Technology moves on at an accelerated pace and the expectations of our customers are raised. Of course, it’s never possible to predict the future – and we can’t prepare ourselves for every eventuality – but by changing our mindset we can equip ourselves to manage change.

Embracing change helps us prepare for, and respond positively to, disruption.

A key element to the approach is building cross-functional teams on projects, so you can add real value to the organisation by breaking down silos and making sure that all the expertise needed to deliver are working together in one team. Maybe we should embed a digital or data expert alongside our tax advisors or corporate finance contacts? Bringing together a range of perspectives result in new ideas that help us deliver differently, we use data to manage in ways we haven’t thought of before and, perhaps most importantly, we collectively develop a better understanding of our customers and markets. The exchange of knowledge, experience and insight produces highly effective results.

We’re going through the process here at B&T as part of building our Firm of the Future.

We brought people together from across the business and identified key areas that we wanted to address, breaking everything down into small, manageable and actionable tasks.

While our priorities were obviously specific to our firm, you could think in general terms about areas in your own business, such as billing processes, customer relationships or technology. What are the issues that are most important to you and the changes that you anticipate could deliver real value?

You approach the tasks in a structured way with regular, delivery deadlines, often within teams. It relies, of course, on participants being ready to jump in and embrace the process. It’s also important to have buy-in from senior people within the organisation and strong leadership in place. We have been really impressed with the amount of progress that we are able to make using the new tools, techniques and ways of working.

My advice is to start small and perhaps choose one area of your business to look at. It may not be the issue causing you the biggest headache (or be the one that is most difficult to address) but it will demonstrate the approach and secure some buy-in. Try to maximise the use of data as well, to help you make the right decisions.

Although different organisations will benefit in varying ways, embracing the change is a philosophy that can be adopted by both commercial companies and public bodies and by small and large businesses alike. A whole new way of working may not always be easy at the start, but in a world of fast-paced change, the approach is essential for longer term survival and success.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Seeing things from a new perspective

Accountancy firms that are part of the HCWA network offer a unique range of perspectives and employ people from a variety of different backgrounds. JONATHAN BROWN explains how he came to join Barnett & Turner in Nottinghamshire and why he thinks his move has been so positive.

Working in an independent accountancy business has been quite a new experience for me. That’s because originally I trained in the public sector.

Of course, there were plenty of personal motivations for the move – not least the fact that I was undertaking a lengthy commute into Sheffield each day as a trainee management accountant. Ultimately though, I feel the culture here suits me much better.

We’re a tight-knit team and there’s a family feel to the business, which is important to me. Inevitably, when I joined the public sector after graduating from university in Accountancy and Finance, I found things to be pretty hierarchical. It can be a political environment with a number of restrictions, so getting things done can be quite a long-winded process.

Here, although things are on a smaller scale, there seems to be much more variety. Dealing with clients in the private sector, you don’t feel as if you’re doing the same job more than once. You’re always on your toes, there’s lots of responsibility and you feel valued, by both our clients and within the team.

From a client perspective, you get the best of all possible worlds. Our team may come from a variety of backgrounds and have insights into the way that different organisations work. At the same time, we’re given a sense of ownership and a really varied range of tasks. That makes us truly committed, responsive and ready for whatever challenge gets thrown at us next!

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Being true to your values may take a little bit of reflection

Like a chameleon, the environment at Barnett & Turner is changing. And it’s all to do with the unique ‘Culture Club’ set up by Jono Wilson - Here, he makes the case that every organisation can benefit from a little open discussion, reflection and renewal to get the best out of any team!

When you manage a business, it can sometimes be too easy to keep ploughing on in the same direction. After all, you’re preoccupied with day-to-day pressures and deadlines. But it’s healthy to take stock once in a while and reflect on the way that everyone interacts with one another and the expectations we have for behaviour.

That’s exactly what we’ve done recently at my own accountancy firm. Barnett & Turner has been around for 110 years or so and as a business we continue to learn, change and improve. So I have brought together a group of staff to form what we’ve called our ‘Culture Club’ to review, redefine and take ownership of our business culture, ensuring that we play by the right rules to maintain a positive environment for us and our clients.

It’s a process that I believe could benefit almost any company.

We have a range of people involved. Some are client-facing fee earners, while others work behind the scenes. There’s a good male-female balance and a variety of ages, so we get a healthy range of perspectives.

Our aim is to focus on what we need from each other as people, to ensure our continued success both as individuals and as a business. We started out by considering who we admire externally – friends, sportspeople and others with a high profile. Could we bring some of their traits and habits into the work that we do here?

After plenty of discussion, we’ve produced a ‘play-book’ which pulls together the cornerstones of what we consider to be our unique culture and how we want the firm to be – for us, it is much more than just a mission statement or staff handbook! The principles include making a difference to our clients and each other, being true to our values, ownership and trust, honesty and commitment and solution based thinking. We’ve also included fun and positivity - it’s important to show some love!

We’re currently preparing to present our play-book to the wider team working in the business and I admit to being excited at the prospect, as everyone has been so engaged in the process so far. I’ve also found that it’s given me a new lease of life and motivation as a leader.

Our intention is to use the Culture Club as a talking point with new recruits and to share the play-book in interviews. It means we can be quite clear and up front with them: “This is who we are and what we expect. Do you feel that you will fit in and are you excited at the prospect of joining B&T?”

Over time, the values will become a benchmark for appraising our work and behaviours. We will challenge ourselves to check that we’re living up to our aspirations and embracing the culture that we have collectively agreed to create.

It takes a little time and commitment, but I really believe it’s worth the effort and I have no doubt that it will help us get the best out of each other. Perhaps it’s time to consider creating your own version of the Culture Club?

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Keeping an eye on your business via the cloud

One of the great advantages of cloud accounting is that your professional adviser is there with you in real time, writes Natalie Goodall of accountancy firm Barnett & Turner

While it’s true that the key driver for using cloud accounting systems has been the government’s Making Tax Digitalprogramme, we’d usually advise all our clients to work in this way, even if they’re not VAT registered.

From our point of view, there are a number of advantages, if we notice for example, that profitability is healthy, we can work proactively to manage tax liability. On the other hand, if a client’s figures are not looking so rosy, there may be another conversation we can have, which gives us the chance to offer some specific advice or recommendations.

A key advantage is the ability to spot problems before they get out of hand. Keeping accounts in the cloud means that your professional adviser is able to log on at any time and see exactly what’s going on. While some businesses joke about ‘Big Brother’, the reality is that they soon see the advantages.

As cloud accounting became more commonplace, we started checking in on client accounts on an ad hoc basis, but we are now putting systems in place to ensure regular monitoring.

In terms of practical impact it can make, think about notification of your corporation tax bill. Would you rather have an idea of the figure eight months in advance or just a week before it became due?

Most accountants will be happy to offer some training to clients, depending on their level of confidence with software such as Xero, Sage or QuickBooks. Inevitably though, queries arise from time to time and we find that this serves as a useful communication channel. When a client calls up to ask for advice on the software, there’s always an opportunity for a five-minute chat to get up to date on their business and accounting issues.

We work closely with the leading providers, Xero and QuickBooks, and are cloud certified advisers. If you haven’t yet taken advantage of the new technology, make sure to have a chat with us to see how we can help with a stress-free demo and set up options.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk